The Ministry of Finance announced the issuance of Cabinet Resolution No. (106) of 2025 regarding violations and administrative fines resulting from non-compliance <a href="https://jordangazette.com/faraday-future-makes-a-striking-appearance-with-its-fx-super-one-and-ff-91-2-0-across-the-uaes-seven-emirates-in-celebration-of-the-nations-54th-national-day/”>with the legislation regulating the Electronic Invoicing System, as part of the UAE’s efforts to support the digital transformation journey and reinforce tax compliance in line with global best practices.

The resolution applies to all entities required to implement the Electronic Invoicing System in accordance with Ministerial Decision No. (243) of 2025 concerning the Electronic Invoicing System, while persons applying the system voluntarily are exempt from the resolution, and no fines will apply to them until they become mandatorily subject to the Electronic Invoicing System.

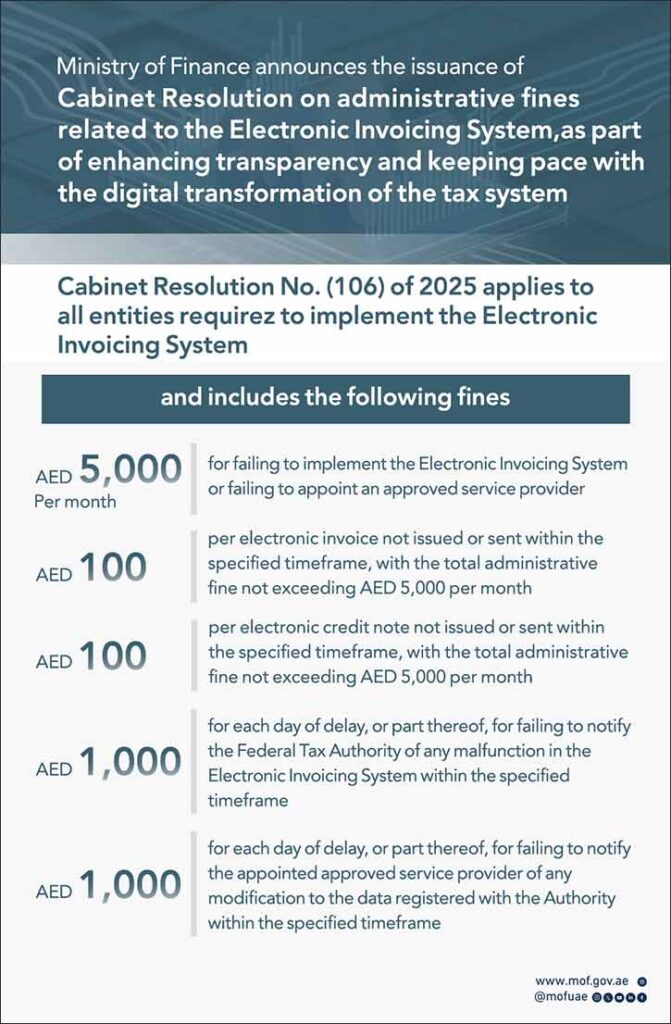

To ensure effective compliance, the resolution specifies the administrative fines imposed for violations related to the implementation of the Electronic Invoicing System by persons required to apply it. These fines include the following:

This resolution represents a pivotal step in the UAE’s digital transformation journey and reflects the government’s firm commitment to applying international best practices in transitioning to an integrated digital economy.